Since the introduction of Bitcoin, cryptocurrency trading has gone a long way. Trading has gotten more efficient and lucrative as the market has evolved. In this post, we will look at the most recent smart trends in bitcoin trading that have swept the sector.

Introduction

Cryptocurrency trading is one of the world's most profitable markets. Cryptocurrencies are appealing to traders because they provide a unique chance to invest in a decentralized, transparent, and safe system. Cryptocurrency trading, on the other hand, is a complicated and volatile industry that needs specific knowledge and abilities.

Trading With Algorithms

For some years, algorithmic trading has been a buzzword in the banking business, and it has now infiltrated the cryptocurrency market. Computer programs are used in algorithmic trading to conduct transactions based on pre-defined rules and algorithms. This kind of trading is more efficient, speedier, and less prone to mistakes than manual trading.

Social Buying and Selling

Social trading is a new cryptocurrency market trend in which traders share their techniques and insights with other traders. This style of trading enables beginner traders to learn from professional traders and automatically follow their trades. Social trading platforms offer a safe and transparent environment for traders to discuss and evaluate their transactions.

Exchanges that are not centralized

Decentralized exchanges are a new sort of cryptocurrency exchange that uses a blockchain network to function. Decentralized exchanges, as opposed to standard centralized exchanges, enable users to trade cryptocurrencies without the assistance of an intermediary. Decentralized exchanges are safer, more transparent, and less vulnerable to hacking than centralized exchanges.

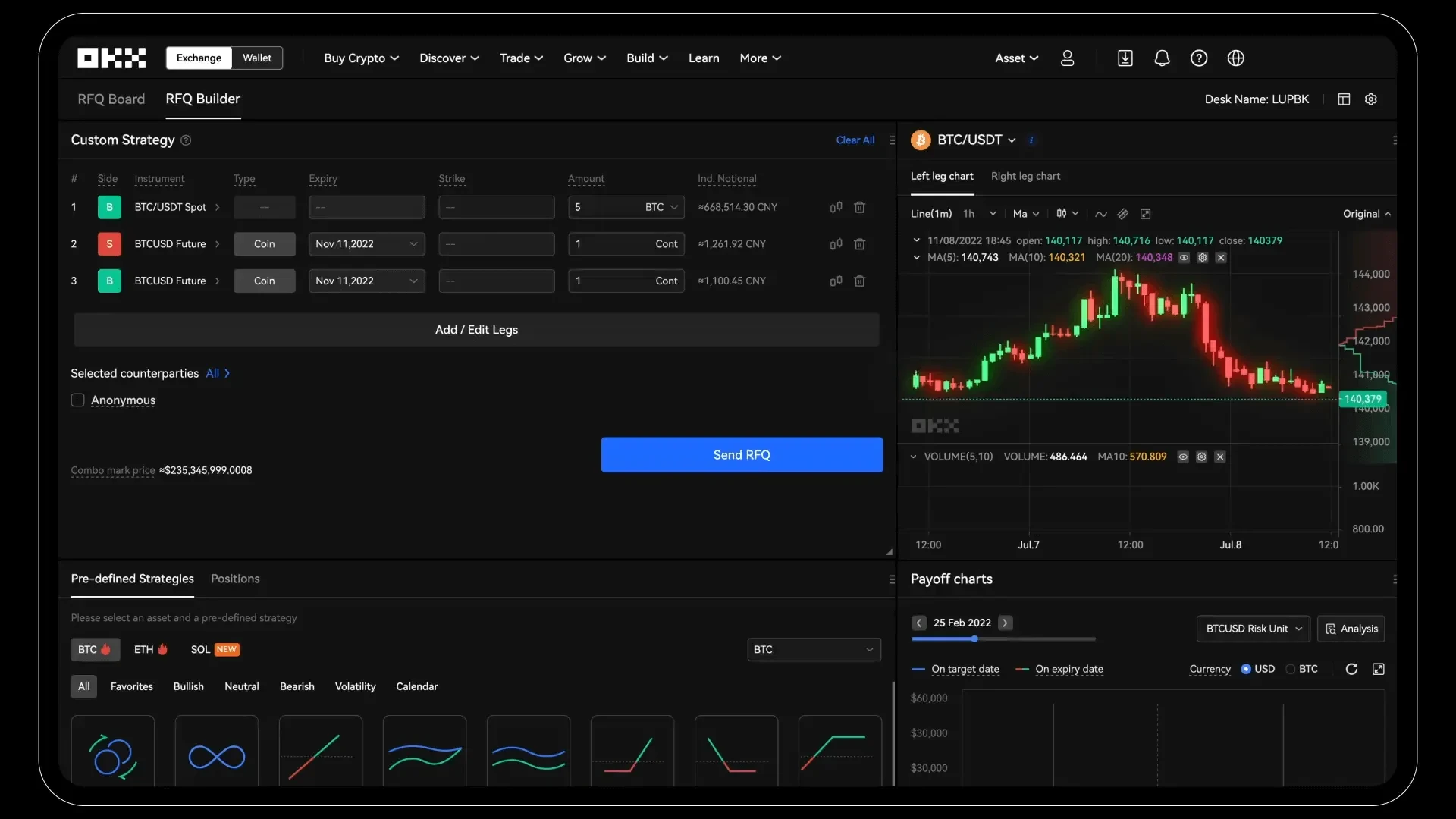

Trading in Derivatives

Derivatives trading is a sort of trading in which traders bet on the future value of cryptocurrencies without actually holding them. Options, futures, and swaps are examples of derivatives trading. This sort of trading is more adaptable than spot trading and enables dealers to hedge against market volatility.

Offerings of Security Tokens

Security token offers (STOs) are a new technique to raise cash by selling security tokens. Companies may use STOs to create tokens that reflect ownership or stock in the firm. This sort of offering is more regulated and transparent than initial coin offerings (ICOs), and it provides investors with additional legal protection.

Stablecoins

Stablecoins are a sort of cryptocurrency that is intended to have a consistent value. Stablecoins are tethered to a fiat currency, such as the US dollar, and attempt to reduce cryptocurrency volatility. Stablecoins are gaining popularity as a safe and reliable mode of payment as well as a store of wealth.

Lending in Cryptocurrency

Crypto lending is a new cryptocurrency market trend in which investors may earn interest on their bitcoin holdings. Crypto lending services enable investors to earn money by lending their cryptocurrency to other traders or borrowers. Since it is backed by collateral and works on a blockchain network, this sort of lending is more secure and lucrative than conventional lending.

Trading With Artificial Intelligence

Artificial intelligence (AI) is gaining traction in the bitcoin sector. Machine learning algorithms are used by AI-based trading systems to assess market data and make trading judgments. Traditional trading methods are slower, less precise, and more prone to human mistakes than AI-based trading systems.

Tokenization

Tokenization is a new cryptocurrency market trend that enables businesses to transform assets into tokens. Tokenization enables businesses to raise funds by issuing tokens representing ownership of assets such as real estate, commodities, or artwork. Tokenization makes asset ownership and trades more efficient and transparent.

Platforms for Trading on Several Exchanges

A new kind of trading platform that enables traders to access numerous cryptocurrency exchanges from a single interface is multi-exchange trading platforms. These are the platforms.