Trading cryptocurrencies is a fascinating and possibly rewarding hobby, but it can also be rather difficult. The market is turbulent and unpredictable, and traders must have a thorough grasp of the sector and the technology that underpins it. To be a good cryptocurrency trader, you must have a solid trading strategy and stay current on the newest trends and tactics.

We will explore some advanced tactics for bitcoin traders in this post to assist them to improve their trading abilities and enhance their earnings. We'll talk about risk management, technical analysis, and fundamental analysis, among other things. Let's get this party started!

Strategies for Risk Management

Risk management is critical in bitcoin trading. To reduce losses and safeguard their wealth, traders must have a good risk management approach. Stop-loss orders, position size, and diversification are all prominent risk management approaches.

Stop-Loss Instructions

Stop-loss orders are a basic yet useful technique for risk management. Traders may use them to sell their holdings automatically when the price of a cryptocurrency falls below a specified threshold. This may assist traders in limiting their losses and avoiding being trapped in a negative trend.

Position Dimensions

The amount of money a trader assigns to each deal is referred to as position size. Traders must decide the right position size depending on their risk tolerance and the trade's potential payoff. As a general guideline, never risk more than 2% of your trading money on any single deal.

Diversification

Another important risk management method is diversification. Traders may diversify their portfolios by investing in numerous cryptocurrencies or other asset types like equities, bonds, or commodities. This may assist minimize their portfolio's total risk and deliver a more steady return.

Technical Evaluation

The examination of price charts and other market data to discover patterns and trends is known as technical analysis. It is a popular tool for bitcoin traders to employ to make educated trading choices.

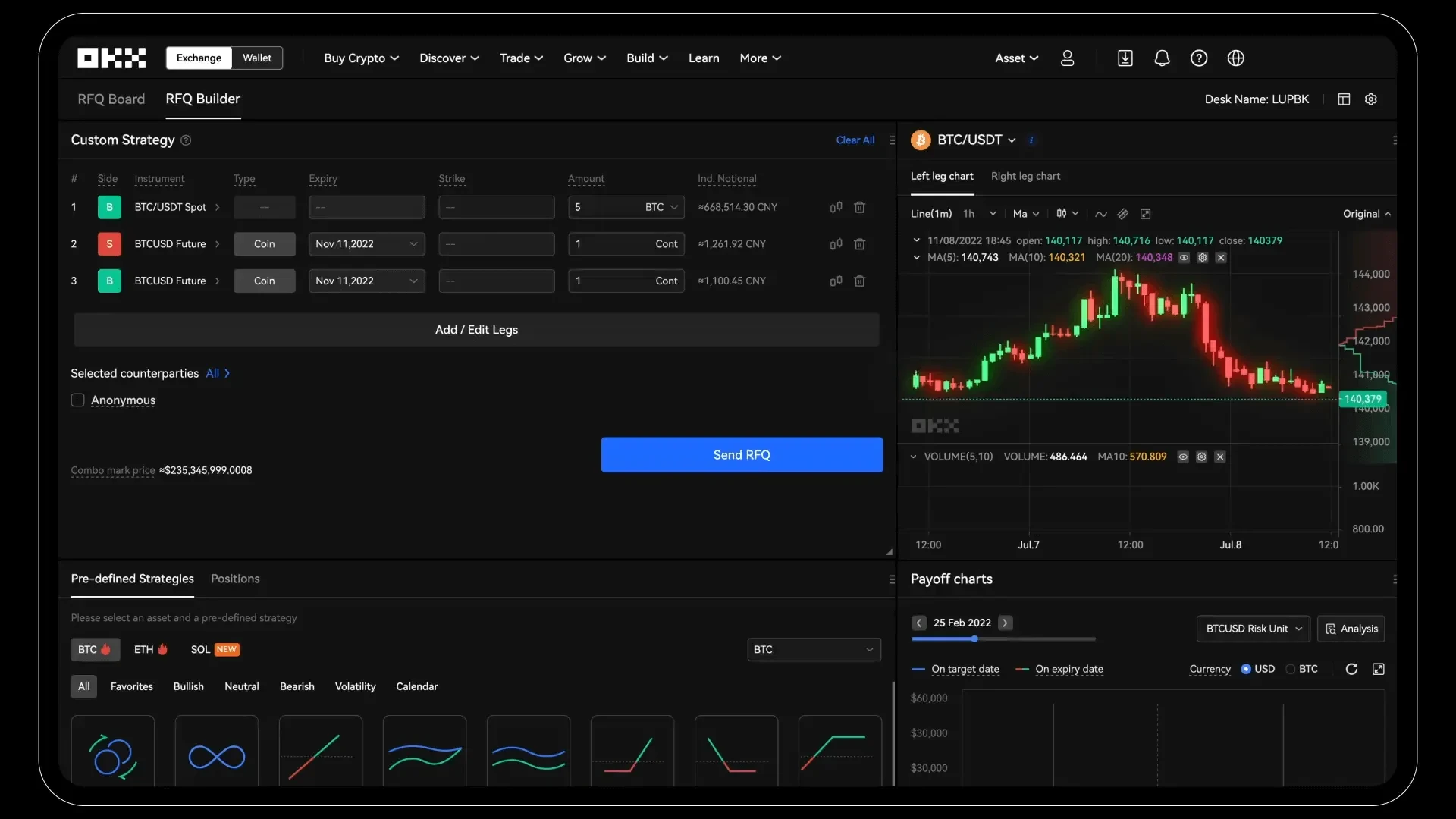

Candlestick Diagrams

Candlestick charts are a common sort of technical analysis graphic. They give a visual depiction of price changes over time and may assist traders in identifying trends and patterns. Doji, Hammer, and Shooting Stars are some typical candlestick patterns.

Averages of Movement

Another prominent technical analysis technique is moving averages. They are used to smooth out price volatility and discover patterns. Depending on their trading approach, traders might use several forms of moving averages, such as simple moving averages or exponential moving averages.

Index of Relative Strength (RSI)

The Relative Strength Index (RSI) is a momentum indicator that may assist traders in identifying overbought and oversold positions. It assesses the severity and speed of market fluctuations and generates buy and sell recommendations.

Basic Examination

The study of economic, financial, and other qualitative and quantitative elements to identify the inherent worth of an asset is known as fundamental analysis. It is a great tool for cryptocurrency traders to assess a coin's long-term potential.

Whitepapers

Whitepapers are an excellent resource for bitcoin traders. They present a full introduction to bitcoin technology and the challenges it seeks to answer. Traders may utilize whitepapers to assess a cryptocurrency's long-term prospects and make educated investment choices.

Recent News and Events

The price of a cryptocurrency may be significantly influenced by news and events. Traders must keep current on industry news and events such as regulatory changes, collaborations, and product launches. This may assist traders in identifying prospective purchasing or selling opportunities.

Capitalization of the market

A cryptocurrency's market capitalization is its overall worth. It is a key indicator for traders to consider when assessing the possibilities of a transaction.